Posts Tagged "Business Buyout"

Yes! Alternatives to Selling to a Competitor or Private Equity

Perhaps the two biggest myths about selling your company are:

- Your buyer must be a competitor or a private equity firm, and

- When you sell, you must give up control.

Thankfully, neither myth is true.

This educational webinar presents an alternative strategy to achieve the goals that most business owners seek: maximizing personal wealth, maintaining control until you wish to exit, and setting up the company for long-term success.

Register and attend this webinar to learn:

- When it may be right to sell your company to a competitor or private equity group, and when it may be the wrong decision

- How to get cash out of your company without giving up control

- How to position the company for long-term growth and success

Register Now

Contact Tim 772-221-4499, to discuss strategies for your business.

You Wouldn’t Sell to Just One Customer at a Time, So Why Sell Your Company That Way?

By: Patrick Ungashick

One of the most common mistakes owners make in their exit planning is negotiating with only one potential buyer for their business. Rarely, this works out fine, and the business sells for the desired price. However, more often than not, negotiating with only one potential buyer at a time undermines your exit success—sometimes without even knowing that you lost something.

Here are five reasons why you may come up short if you only talk to one potential buyer at a time:

1.You don’t know if you are talking to the buyer who will pay the highest price.

For most businesses, there are multiple potential buyers out there. Within the universe of potential buyers, some will be more motivated than others to acquire your company. Remember—the buyer’s motive makes the multiple. So, unless you happen to get lucky, the simple odds are that you are not talking to the most motivated potential buyer for your business. Making matters worse, you have no way to recognize if you are talking to the best buyer or not without other potential buyers in the conversation.

2. You also don’t know if you are talking to the buyer who is the best fit for your company.

When selling their business, most owners seek more than just the top price. If you are like most owners, when you go to exit, you will prefer to sell to a buyer that is a good fit for your organization, a buyer that will continue your culture, treat employees fairly, and serve customers well. Again, unless you happen to get lucky, the odds are that you are not talking to the best fitting buyer. And, here too, the only way to know is to include other potential buyers in the conversation.

3.Talking to just one buyer eliminates any competitive pressure in your favor.

If you are negotiating with only one potential buyer, that party knows it has no competition to acquire your company. It has no incentive to put forth its top price or most attractive terms. It has nobody bidding against it. Even if you believe that you want to sell your company to this one buyer, you don’t have a second buyer to create any pressure. Consequently, you have little leverage within the negotiations. Without other potential buyers in the picture, the one potential buyer is mostly free to set the price on its own, dictate the process and timetable, and secure an outcome favorable to itself. The whole situation validates the old saying, “In a potential negotiation between one party with all the money and another party without any, the party with the money will win.” Most potential buyers have a lot more money than you do, and if it’s just you and one buyer in the negotiation, likely they will win.

4.You have little to no protection during due diligence.

During the due diligence phase, some potential buyers look for opportunities and justifications to lower the final purchase price. (This is called “retrading” the deal.) You can attempt to negotiate with your potential buyer to keep the price up, but you have little leverage short of walking away from the negotiations, and your potential buyer will know this. It is easier said than done to walk away from a deal once you are this far along because you will have months invested in transactions, as well as tens of thousands of dollars in expenses and endless emotional capital. With just one potential buyer in the picture, you are at a disadvantage all through the process, but especially during due diligence.

5.Getting your deal done may take more time and present greater risks.

Without competition, your potential buyer feels little pressure to get the deal done. This leaves them in control over timing. The longer your sale takes, the higher the risks for you. For example, something could happen, which gives the potential buyer leverage to lower the price, such as your business misses a monthly sales forecast. Or, a customer or competitor could learn about your potential sale before you are ready. Time is the enemy of all deals. As time increases, the effort and cost you have invested in this possible deal increase, making it harder for you to walk away—a vulnerable position for you. Potential buyers know this, and use it to their advantage.

Your Exit Plan and Selling Your Company

With few exceptions, business owners seeking to sell their company at exit are better served by working with advisors who will run an organized process that confidentially brings multiple potential buyers into the picture. A competitive process creates positive price pressure, increases your options, and likely leads to exit success.

At NAVIX, we have helped hundreds of business owners plan for and achieve successful exits. To learn more about what goes into an exit plan, start here. Or contact us with your questions.

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499

Seven Requirements to Pull Off a Family Business Exit

By: Patrick Ungashick

If your exit strategy is to pass your business down to a member of your family, you face a unique set of issues, different from business owners who plan on selling their company when they exit. Woven into these issues are family dynamics, relationships, and realities which can at the very least complicate matters, and at worst prevent a successful exit. In our experience, there are seven conditions that you must address to successfully and happily pass a business down to the next generation. Reviewing these conditions helps you evaluate how prepared you are to pass your business down to family.

1st Condition: The Company Must Run without You

If you intend to pass your business down to your children and have the business not just survive the transition but thrive going forward, then the company must be able to run without you. There are two sides to “running without you.” The first deals with processes: all the company’s essential day-to-day operations including sales (from lead generation through closing), delivery of products/services, finance, problem-solving, etc. must operate effectively without your involvement. The second aspect deals with people: all critical internal and external relationships must conduct without your involvement and presence. If the company’s important processes or people relationships cannot function without you, then you cannot pass it down to your children without risking disaster.

Creating a company that runs without you is not easy. Building a team of sufficient caliber to run and grow the company without you takes years of planning and work.

2nd Condition: Your Child (or Children) Can Run the Company

Because the first condition is that the company must be able to run without you, the second condition must be that your child (or children) can run the company. It’s not enough to have hard-working, smart, mature children just working in your family business. One or more of them must have the talent, vision, and drive to lead the company today and into the foreseeable future. Finding successor leadership of this caliber is hard anywhere—finding or developing the leadership of this caliber within your family can be even more challenging. Also, it is important that your exit and succession planning build time into the process to let your children demonstrate that they can run the company before fully turning it over to them. They will need the opportunity to prove to you, other employees, customers, lenders, etc. that they have earned the future leadership role, rather than received it due to nepotism. (See the 5th Condition below.)

3rd Condition: Your Children are Prepared for the Risks of Ownership

Your children must be more than just qualified and proven to run the company; they also must be prepared for the risks that come with owning the company. Business ownership carries inherent risks, and in many family businesses, the successor children are unfamiliar with these risks and have never had to shoulder their responsibilities. For example, if you personally guarantee the company’s line of credit or other financial obligations, your children may be unfamiliar with this obligation and lack sufficient personal wealth to meet current and future credit requirements. Your children also may have never experienced owning the company through difficult economic times, such as a recession or industry downturn. It is not possible to protect your children from every business risk, but the key question is, are they prepared to handle the risks that you know come with ownership.

4th Condition: The Rest of the Family Supports the Succession

One of the great challenges within most family-owned and led companies is getting all the necessary family members on the same page while avoiding decisions or actions that cause dissention and strife. When it comes to passing a business down to the next generation of family leaders, preventing dissention often gets much harder, as most if not all family members are impacted in some manner by this event. For example, if you have some children working in the company but some who are not, then treating all your children fairlymay be difficult if only some children are going to “get” the business while others won’t. These issues can be emotional and sensitive within the most tight-knit, close families. Add into the picture complicating factors like second marriages or adult-age children who are not acting like adults, and fulfill every family member’s wants, and needs may seem impossible. Again, the sooner family-led companies start talking about and addressing these issues, the more time they give themselves to achieve a successful outcome.

5th Condition: The Rest of the Company Supports the Succession

To pass a business down to your children, your family must ultimately support the exit and succession plan, and the rest of the company’s key leaders must support it too. To the extent, you have addressed the 2nd and 3rd conditions described above, likely you will secure the support from the company’s non-family key employees because they will have seen your children effectively running the company and qualified to be owners. However, if you have co-owners (business partners) outside of your nuclear family, gaining their support may be more complicated no matter how qualified your children may be. Typically, your partners will not want to see the business that they own a portion of being passed down to your kids, either because they want their children (if applicable) to have the ownership opportunity, or because they want to sell the company for an attractive price. In these situations, the simplest solutions (share the company between everybody’s kids, or buy out the other owners) are rarely simple to implement.

6th Condition: You Can Reach Financial Freedom without Over Burdening the Company

Most business owners are financially dependent on the company. To some degree, you need your income from the company to support your current lifestyle, and one day you will need to convert some to all of your business wealth into personal wealth to reach financial freedom and retire. You can’t happily and successfully exit and pass your company to your children if that cuts you off from your financial security.

Owners who exit by way of selling their company to an outside buyer have an apparent mechanism for how they will reach financial freedom—the liquidity event created with the company sale. However, if you intend to pass the company to your children, there usually will not be a liquidity event. Alternative mechanisms, such as the company/kids borrowing money to buy you out, or the company keeping you on the payroll indefinitely, can help you reach financial freedom but they create significant long-term financial burdens (and sometimes tax problems) for the company. Ideally, family members will recognize and start addressing this issue long before the current owner(s) want to exit and adopt tax-favorable strategies to build wealth outside the company long before you are ready to exit.

7th Condition: You Have a Plan for Dealing with the Taxes

Passing a business to your children triggers potential transfer taxes—commonly gift taxes (if the transfers occur while living) and estate taxes (if the transfers occur at death). A high tax bill can cripple even the soundest succession plan. Recent tax law changes provide some tax relief, but only through 2025. After that year, the potential taxes owed on asset transfers are scheduled to return to significantly higher levels. You must consult your tax advisors to determine your situation, and if you need to consider taking action as part of your overall exit plan.

Your Last Five Years

Preparing and implementing an effective plan to pass a company from one generation to the next requires a thorough review of the company and the family, followed by discussions, brainstorming, modeling, and assistance from experienced advisors. In other words, exit planning takes time and work. If you are telling yourself you want to exit sometime in the next five years, now is the time to take action to address these seven conditions in your family business. For help, download our complimentary ebook Your Last Five Years: How the Final 60 Months Will Make or Break Your Exit Success to get started.

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499.

How Much Is Your Company Worth According to Your Buy-Sell Agreement?

Here’s the story of how one business owner’s buy-sell agreement understated his company’s value by a factor of 10, and what you need to know for your own business value and exit planning.

We recently spoke with the majority owner of a professional services firm who has several minority partners. All of them have signed a buy-sell agreement1, which is typically a good and advisable way to mitigate risk.

The majority owner contacted us because he was suspicious that their agreement was drastically understating the value of his company, and as a result his minority partners were expecting to one day purchase his majority interest at a drastically lower price. He was right to be suspicious.

Book Value Isn’t Always an Important Factor

His company’s buy-sell agreement stipulated a formula of 2.5x book value to determine the overall value for the company. The problem was that for a professional services firm, book value is next to meaningless.

Book value is commonly understood to mean the net value of the company if you simply sell off all the assets and pay off all the debts. Book value therefore ignores the potential value of the company as an ongoing enterprise, including its goodwill.

While book value can be an important factor in asset-heavy industries such as manufacturing and distribution, it usually has little relevance in service-oriented companies. Rather, this owner’s company would ideally be valued based on a multiple of its profits (or revenue in certain circumstances).

Because we have worked with other clients in the same industry, we knew the relative value of his company if he sold to an outside buyer in the open market. That number was about 10 times greater than what his buy-sell agreement stipulated. Needless to say, this majority owner had no intention of selling his company to his two minority partners for a 90% discount, which is exactly what the agreement stated would happen.

The gap between this owner’s market-based business value and what his buy-sell agreement called for was pretty dramatic. However, his situation is common. Many owners are unaware of what their company is worth — according to their own legally-binding buy-sell agreements.

Why Do Such Disparities Happen?

Too often, what the buy-sell says is considerably different than what the company could be worth to an outside buyer, creating the potential for serious problems should the agreement ever be invoked.

This disparity happens for several reasons. First, market conditions change. The value or valuation method used when the buy-sell agreement was written may be considerably different than a value based on current market conditions.

Even if a formula was used, presumably to allow for some change and flexibility, that formula may be out of date. At the speed with which markets change, it can only take a year or two at most for the buy-sell agreement valuation to become a problem.

Second, businesses change rapidly, too. Where your business was and what your business looked like when the buy-sell agreement was written might be materially different from what the company looks like today.

Needs and objectives change with time as well. That’s what happened to this particular business owner. At the time the buy-sell agreement was written, he was trying to get several key employees to buy into the company at an affordable price, thus his advisors wrote a discounted price into the legal document. That may have made sense at the time, but since then his company had dramatically increased in both size and value, making the 2.5x book value approach not only obsolete but even harmful.

How to Maintain a Good Buy-Sell Agreement

What do you need to do with your company’s buy-sell agreement to avoid a similarly contentious situation? Consider these steps:

- Review the agreement no less than annually. Do not let it grow stale.

- Get input from your advisors — not only your attorney (because this is a legal document) and accountant, but also exit planning advisors who can provide perspective and data on current market conditions

- Be flexible. Your buy-sell agreement does not have to apply the same valuation methods to all situations. For example, if you want to sell a portion of your company to a key employee at a lower price, you likely can do so without hard-coding this lower price into every circumstance addressed in the agreement.Also, your buy-sell agreement can apply different valuations to different events. For example, if a minority owner dies, the buy-sell agreement might call for a buy-out of that person’s interest at full price, but if a minority owner is fired for reasonable cause the same buy-sell agreement might apply a deeply penalized, discounted price when buying back those shares.

For more help on this issue and dealing with business partners and co-owners, download our free ebook, Creating Co-Owner Exit Alignment. Or contact us if you have a quick question about your buy-sell agreement.

1 Also called a shareholder agreement, a buy-sell agreement is a legal document that usually has provisions that predetermine how certain ownership-related situations will be handled, such as the buyout of one or more owners due to death, disability, or other separation from the company. In many situations the buy-sell agreement is a standalone document. However, sometimes the buy-sell provisions are embedded in another legal document, such as the operating agreement in the company if it is an LLC.

To learn more about the steps necessary for a successful exit, contact Tim for a complimentary consultation: 772-221-4499 or email.

When It Comes to Exit, Do Not Go Out on Top

Athletes, celebrity entertainers, politicians, models—everybody seems to want to “go out on top” at the end of their careers. At first glance, it should be the same for business owners; they, too, should strive to go out on top when they exit from their business. After all, in order to sell the business for maximum value, create a sustained business legacy, and exit under their own terms, owners should exit at the business’s peak—right? Perhaps not.

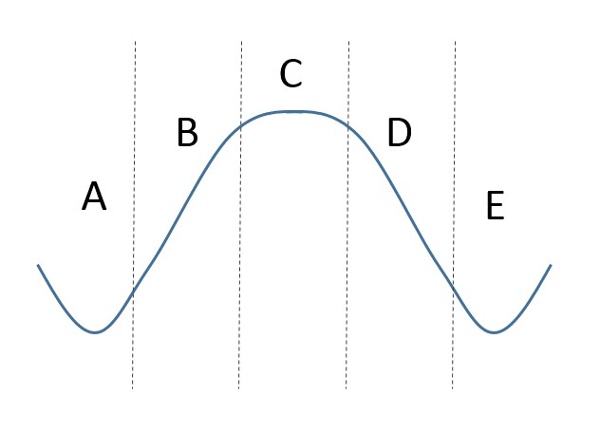

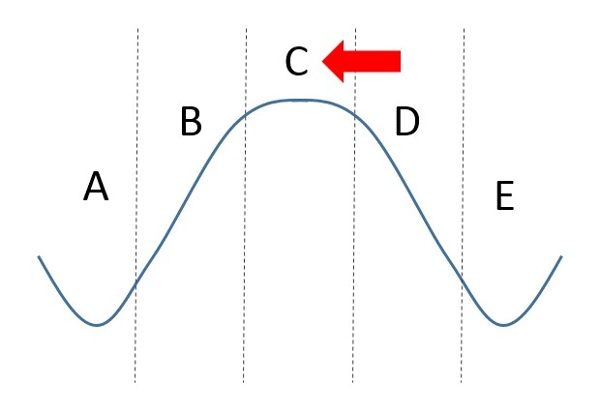

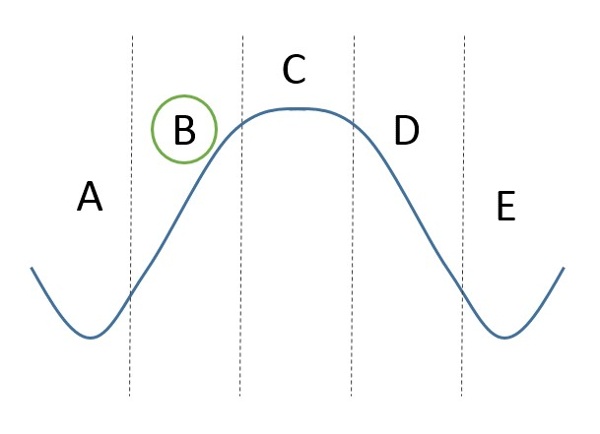

Few companies grow in a perfectly straight upward line; most experience varying rates of growth over time. Consider the following simple illustration of a business’s growth cycle, divided into five phases, lettered A through E.

Ask a room full of business owners which is the ideal phase from which to exit their company, and the most common answer is Phase C as shown below.

On the surface this makes sense. If your goal is to sell the business for its maximum value, it seems logical to sell when revenues and profits are at their highest. If you want your company to continue so that employees and customers are not left stranded, then you might also think that the business needs to be at peak performance to survive the transition. However, it often does not work that way.

To achieve a happy and successful exit, do not go out on top. Rather than exit at Phase C, owners must consider exiting at Phase B in order to achieve their best results.

Here is why. Let’s examine the goal of selling a business for the maximum value. While there are many factors that contribute to a business’s sale price, one of the most important is the company’s prospects for future growth. Buyers do not purchase a business for its past performance—they only use past performance as a reference point for evaluating the future growth. A business that has peaked is potentially less valuable to a buyer if the company’s revenues and profits may be expected to slow or decline in the immediate future. Buyers need to believe that the business’s next three to five years are likely to be a time of continued profitable growth. That is Phase B, not Phase C.

There is a second reason to consider selling a business to maximize value during Phase B rather than Phase C. About two-thirds of business sales include an earn-out for the seller. Earn-outs are a provision in the deal where the seller may receive additional future compensation based on the business achieving certain future results, such as revenue or profitability goals. Selling the business at its peak in Phase C could lead to receiving less or even nothing from the earn-out.

Next, let’s examine the goal of creating a sustained business legacy. Owners who exit at the peak are turning over their company to successors right when that business is potentially about to go through a difficult time. As the business leaves Phase C, it will likely experience some or all of the following: slowed growth, reduced profits, tightening cash, shrinking margins, increased competition, or declining backlog. Turning over a business in that environment is not a recipe for a smooth transition and does not bode well for creating a sustained business legacy. Owners who want their companies to not only survive their departure but also thrive after their exit may need to act in Phase B, not Phase C.

Last, let’s examine the goal of exiting on one’s own terms. For many owners, this means during and after exit they need to have peace of mind that they did things the right way. Achieving peace of mind comes from honoring employees, respecting customers, acting consistently by a set of values, and upholding the company’s reputation. Owners who exit in Phase C risk jeopardizing all of this, again because of the potential difficulties the business may face ahead as it leaves Phase C. The new owners and leaders may need to take corrective actions such as cutting jobs or scaling back services, undermining the outgoing owner’s sense of leaving the company in good condition.

For all of these reasons, it may be advantageous not to exit on top, but rather before the company reaches its next performance peak. This is easier said than done. First, you must assess where the business is within these various phases. While it is impossible to predict the future, it is possible to make forecasts based on careful monitoring of industry and economic trends, combined with proven strategic planning processes. You are not guaranteed to be right, but a sound forecast increases the likelihood of success.

The second major challenge when attempting to exit prior to the company’s peak is emotional—it is difficult to leave a business in Phase B. Phase B typically produces some to all of the following: rapid sales growth, increased profits, strong backlog, improved margins, surplus cash, eager customers, and high employee morale. Few owners want to exit from a company while having that much fun. Yet to exit successfully, that is often what is required.

Consider watching our on-demand informational webinar on how to know when it’s time to exit.

To discuss your unique business, and how to plan for and achieve a successful exit, Call 772-210-4499 or email Tim to schedule a confidential, complimentary consultation.

How to Reach Financial Freedom When You Sell, and How to Stay There

Time after time, client after client, research study after research study, the answer remains the same — business owners’ number one goal at exit is to achieve their financial win, whatever amount that might be. In our experience, the most common financial goal is to reach financial freedom, which we define as getting to the point where working is a personal choice, not a necessity. Money cannot buy happiness, but business owners who have successfully reached financial freedom seem to smile on a regular basis.

The same can be said of businesses too. Take two companies from the same industry … read more

Sign up for the complimentary educational webinar on this topic.

Date: Tuesday August 22, 2017

Time: 2:00 pm – 3:00 pm EDT.

Click Here to REGISTER

For more on this topic- Click here to watch videos on this and related topics.

Call 772-210-4499 or email to find out more about this webinar and exit planning solutions. Ask about our complimentary proprietary tools and checklists. All inquiries are confidential.

What Should You Do with All Those Unsolicited Buyout Offers?

http://navixconsultants.com/webinars/If you are like most business owners, you are probably receiving a regular flow of emails and phone calls seemingly offering to buy your company. Private equity firms are sitting on piles of cash raised over the past five to seven years. Publicly traded companies and other strategic buyers are struggling to create organic growth, and they have record levels of cash on their balance sheets. Everyone is poised for the flood of baby-boomer sellers that never seems to come. As a result, there is too much money chasing too few acquisition opportunities. While generally a good thing for business owners, a torrent of unsolicited offers can grow into an unwelcome time sink if not handled correctly.

READ MORE, LEARN MORE, WATCH MORE:

For more on this topic- Click on the image link below to read case studies, listen in on the complimentary educational webinar, and watch videos on this topic.

Call 772-210-4499 or email to find out more about this webinar and exit planning solutions. Ask about our complimentary proprietary tools and checklists. All inquiries are confidential.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.