Posts Tagged "Exit StrategyTax Cuts and Jobs Act (TCJA)"

Tax Update for Business Owners: IRS Proposes No “Clawback” on Gift Taxes

The IRS has recently proposed new regulations to resolve one of the lingering questions raised by the sweeping Tax Cuts and Jobs Act (TCJA), signed into law slightly more than a year ago.

TCJA presented business owners with a number of important tax changes that impact how you do tax planning today and how you design and implement your future exit plans. (Read more on these new tax provisions, including a helpful infographic.)

TCJA Creates Questions

Like many extensive tax legislative packages, TCJA created a few questions along the way, leaving it to the IRS and other agencies to interpret and clarify the laws where needed.

One of those questions was, “How would gifts and estates be taxed after 2026 for taxpayers who have taken advantage of the temporarily increased gift limits under TCJA?” Here’s the issue. Before TCJA, U.S. taxpayers could gift about $5 million of assets ($10 million for married couples filing jointly) before potentially triggering gift or estate taxes.

Under TCJA, this amount doubled, allowing taxpayers to gift about $10 million of assets (about $20 million for married couples filing jointly). Gifting more assets without triggering a tax is better — especially if you contemplate transferring some or all of your business to your children as part of your exit planning. Under the TCJA, however, this ability to gift twice as much without triggering taxes will expire (or “sunset”) in 2026.

This sunset raises a big question — what happens to taxpayers who take advantage of the new and higher gift limits before the end of 2025 but then die in the year 2026 or later when the limits are lower again? Would these taxpayers or their heirs have to pay additional taxes under the restored lower limits in what is colloquially known as a “clawback”? Experts have been debating this question since TCJA was passed.

How Does TCJA Impact Exit Planning?

Here’s an example of why this question impacts exit planning. Assume a married couple named Oliver and Orphelia Owner gift their company, ABC Co., to their son. The company is worth $20 million. Under the higher gift limits now available courtesy of TCJA, it is likely that no gift taxes would be owed.

Now assume Oliver and Orphelia die in 2026 or later when the higher gift limits have fallen back to only $5 million per person ($10 million for married couples). At their death, Oliver and Orphelia’s estate and heirs could face taxes on the amount they gifted in excess of $10 million under this clawback approach.

The risk of a clawback complicates exit planning for business owners, especially within family businesses. Therefore, the IRS had to take action. The IRS’s proposed solution involves creating a “use-it-or-lose-it” approach, where taxpayers are not at risk of a clawback in 2026 and beyond but must take advantage of the higher gift limits before they expire in 2026.

The IRS’s proposed regulations are being reviewed and should be finalized shortly. If implemented as proposed, this development reduces uncertainty for business owners and creates a need to act to avoid missing out on a tax-saving opportunity.

Review These Issues with Your Tax and Legal Advisors

Many family business owners hesitate to transfer ownership to their next generation for fear of losing control of the company or out of a need to preserve the income stream they enjoy from the company. However, it is possible to make large tax-free gifts of your company without surrendering control or cutting into your income. Ask us how to do this.

Any opportunity to implement business exit plans at potentially lower tax rates is good news. But, if the IRS’s proposed regulations are enacted, business owners cannot afford to miss this opportunity as it will expire. It is important to review these issues with your tax and legal advisors to determine the best course of action for you.

Want to know how this applies to you?

Answers to Your Exit Questions

Schedule a 45-minute consultation to see how you can achieve a financially rewarding exit.

Contact Tim for a complimentary consultation: 772-221-4499 or email.

Exit Planning Under the New Tax Laws

SPECIAL ALERT:

While the Tax Cuts and Jobs Act (TCJA) impacts every corner of the US economy and everyone it in, the new law impacts business owners perhaps more than anybody. The new law also reshapes how owners must approach their exit planning.

Exit Planning Under the New Tax Laws Webinar

Jan 23, 2018 @ 2PM – 3PM EST

Register now

Register now!

This webinar explains how, and covers:

- How the new laws change old assumptions

- Issues business owners must consider under these new rules

- Key provisions of TCJA

Check out our archive of all past NAVIX exit planning webinars:

Click here to view now

Pursuing Financial Freedom Under the New Tax Laws

For most business owners, the number one goal to achieve at exit is to reach financial freedom. (We define financial freedom as reaching a level of wealth where work is a choice, not a necessity.) However, business owners face a number of costs in their pursuit of financial freedom, the greatest of which usually is income taxes. With the US Congress and President Trump enacting into law on December 22, 2017, the Tax Cuts and Jobs Act (TCJA), business owners seeking to achieve financial freedom at exit now have a vastly changed tax landscape to work within. And while the headlines all seem to indicate that TCJA reduces income taxes across the board, the truth is more complicated…

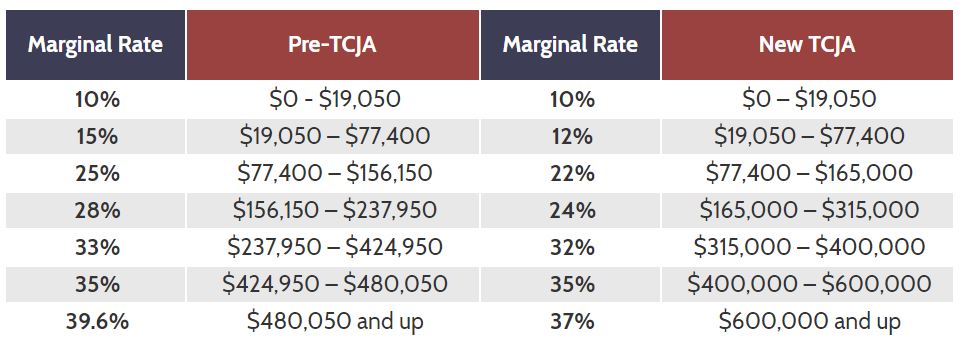

To start, US federal income tax rates have been reduced under TCJA. The top rate is reduced from 39.6% down to 37%, and most of the other rates in the seven brackets are reduced as well. Additionally, income required to cross over into the next marginal rate is now substantially higher, further reducing potential taxes. For example, the chart below compares the new rates under TCJA to the old rates for US taxpayers who are married and file jointly.

There are other potentially positive changes under the new tax laws as well. To point out a few highlights that may apply to business owners seeking financial freedom:

- C-corporation income tax rates have been permanently reduced from 35% to 21%.

- Certain “pass-through” entities, most commonly S-corporations and LLCs, may be eligible for a 20% federal income tax deduction in some situations. Because this new provision of the tax code has the potential for causing significant confusion, we will be hosting a free webinar for business owners on TCJA and how it impacts their exit planning Register today.

- Alternative Minimum Tax (AMT) has been repealed for C-corporations, and exemption amounts increased for personal income taxpayers.

If the story stopped there, it would be all good news. However, Congress giveth, and Congress taketh away too. There are some additional changes to the tax code that may negatively impact certain taxpayers, especially higher net worth and/or higher income business owners. For example, two new provisions likely to negatively impact successful business owners are:

- TCJA limits personal state and local tax deduction to a combined $10,000 for income, sales, and property taxes. This provision will hit hardest taxpayers who live in high-income tax rate states (such as California and New York), and/or taxpayers who own a larger amount of property and pay a more considerable amount of property taxes.

- For primary and secondary residences bought Dec. 15, 2017, or later, you now may deduct the interest you pay on mortgage debt up to $750,000, down from $1 million. Again, business owners with mortgages on first and second homes may face higher taxes under this provision.

TCJA contains dozens of additional provisions that, depending on your circumstances, may reduce or increase your tax bill. Frustratingly, there is one other aspect to the new tax laws that every business owner must understand—most of the personal and pass-through income tax reductions automatically expire (“sunset”) after 2025. This frustrates and complicates planning for financial freedom because owners now must make sure that their financial modeling and analysis accounts for these changes to revert to the pre-2018 rules.

Put this all together, and the most important conclusion is business owners need to sit down and recalculate their plan and path to reach financial freedom. Taxes are likely the number one cost you will pay as you monetize your company and build personal wealth. With the myriad of changes brought by TCJA, old assumptions no longer apply. At NAVIX, we call the process of planning for financial freedom calculating your Exit Magic Number™. To learn more about our approach, download the Exit Magic Number™ eBook.

Now that we have these new tax rules in place, it’s probably time to get started.

Call 772-210-4499 or email Tim to find out more about exit planning solutions.

Ask about our complimentary proprietary tools and checklists. All inquiries are confidential.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.